Domestic Asset Protection Trusts (DAPT) have been around since Alaska established one in 1996. They can now be found in 17 states. Northeast Private Trustees can help you with a DAPT established in New Hampshire.

What is a DAPT?

A DAPT is an irrevocable trust of which the grantor (or creator) of the trust can be a beneficiary of the trust principal. In other words, the trustee, who should be independent, can make a distribution from the trust even to the point of paying the entire amount of the trust to the trust grantor. However, the law in these 17 jurisdictions prevents trust corpus from being taken by creditors and, in many cases, in bankruptcy.

What is the catch? You have to establish the trust under the laws of one of these states and administer the trust there. Northeast Private Trustees has offices in Concord, New Hampshire, one of the states that has a robust DAPT statute. We welcome your inquiries about protecting your assets under New Hampshire law.

What is a NING, DING, and New-HING?

An ING (Incomplete-gift Non-Grantor Trust) is a trust that is not taxable to the grantor. It could be useful to reduce taxes, especially on surtaxes like the Millionaires’ tax, right?

Indeed! An ING is not subject to state fiduciary income tax when set up right.

Investments held in a New Hampshire ING (a “New-HING”) will pay federal tax but will not pay state income tax as long as the trust is not taxable to an individual taxpayer in a state like Massachusetts, for example. You can also do a DING (Delaware ING) or a NING (Nevada ING), but why would you when you can set up a New Hampshire ING in our backyard?

New Hampshire does not have an income tax on trusts of nonresidents and may be ideal for a state-income-tax-free trust. Be careful, shares in an S corporation may be taxable to some beneficiaries, unless precautions are taken in drafting. It is worth the effort to eliminate additional taxes to the trust grantor.

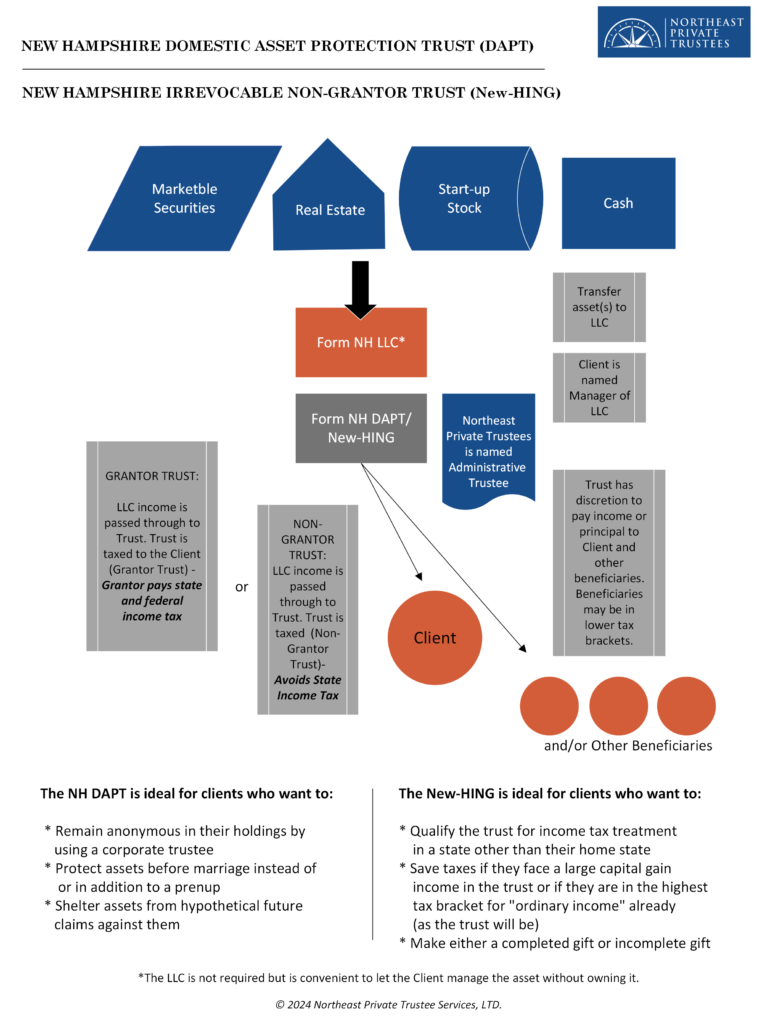

Here’s how they work and a comparison between the two:

Please contact us if you have questions on the usefulness of these unique trusts.